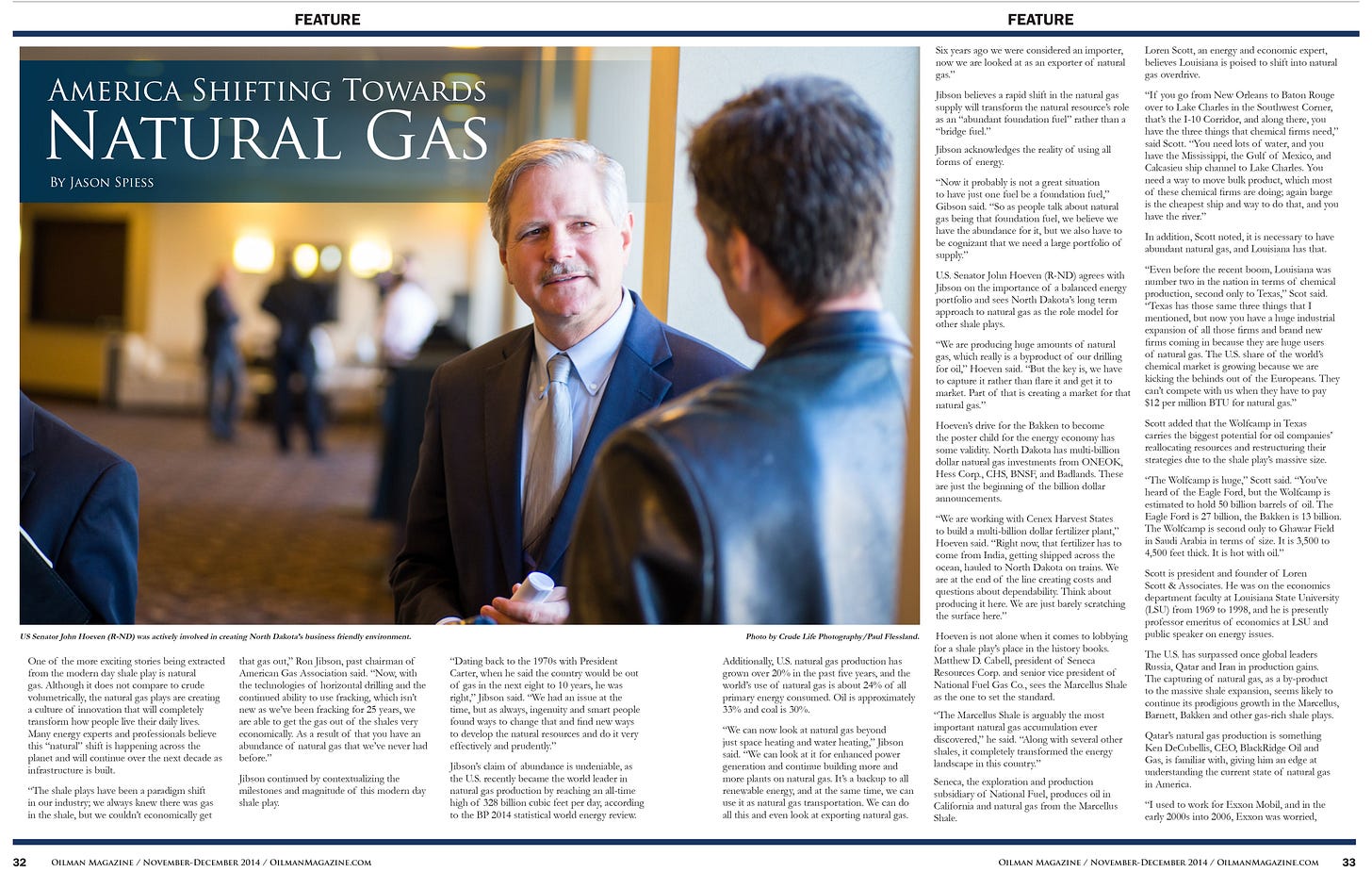

John Gibson talks about the difference between natural gas in the Bakken and Texas.

John Gibson is non-executive chairman of the board of ONEOK, ONEOK Partners and ONE Gas. He most recently was chairman and chief executive officer of both ONEOK and ONEOK Partners after serving as chairman, president and chief executive officer of ONEOK and ONEOK Partners.

Gibson joined ONEOK in 2000 as president of energy, responsible for the company’s natural gas gathering and processing, and transportation and storage businesses. In 2006, he was named president and chief operating officer of ONEOK Partners, the master limited partnership that contains the midstream natural gas and natural gas liquids businesses.

He was elected chief executive officer of ONEOK and president and chief executive officer of ONEOK Partners in January 2007, becoming chairman of ONEOK Partners later that year. In January 2010, he became president of ONEOK; and in May 2011, he became chairman.

Gibson began his career in the energy industry in 1974 as a refinery engineer with Exxon Company, USA. He spent 18 years with Phillips Petroleum Company in a variety of domestic and international positions in the natural gas, natural gas liquids, and exploration and production businesses. When Gibson left Phillips in 1995, he was vice president of marketing of GPM Gas Corporation, a wholly owned natural gas gathering, processing and marketing subsidiary. Prior to joining ONEOK, Gibson was executive vice president of Koch Energy, Inc., a subsidiary of Koch Industries, responsible for its interstate natural gas pipelines and gathering and processing businesses.

A native of Kansas City, Kansas, Gibson earned an engineering degree in 1974 from the University of Missouri at Rolla, now called Missouri University of Science and Technology. He also is a graduate of the Harvard Business School’s Advanced Management Program.

Gibson was a tremendous energy asset for The Crude Life for energy education and awareness and contributed to many articles, features and content series.

One of the more exciting stories being extracted from the modern day shale play is natural gas. Although volumetrically it doesn't compare to the crude, the natural gas plays are creating a culture of innovation that will completely transform how people live their daily lives. Many energy experts and professionals believe this "natural" shift is happening across the planet and will continue over the next decade as infrastructure is built.

"The shales plays have been a paradigm shift in our industry, we always knew there was gas in the shale, but we couldn't economically get that gas out now with the technologies of horizontal drilling and the continued ability to use fracking, which isn't new as we've been fracking for 25 years," Ron Jibson, past chairman of American Gas Association said. "With those technologies we are able to get the gas out of the shales very economically. As a result of that you have an abundance of natural gas that we've never had before."

Jibson continued contextualizing the milestones and magnitude of this modern day shale play.

"For many many years, dating back to the 1970's with president Carter when he said the country would be out of gas in the next 8-10 years," Jibson said. "He was right, we had an issue at the time, but as always, ingenuity and smart people found ways to change that and find new ways to develop the natural resources and do it very effectively and prudently."

Jibson's claim towards an abundance is undeniable as the U.S. recently became the world-leader in natural gas production, by reaching a new all-time high of 328 billion cubic feet per day (BCPD), according to the BP 2014 statistical world energy review.

“The shale plays have been a paradigm shift in our industry. We always knew there was gas in the shale, but we could not economically get that gas out. Now with the technology of horizontal drilling and the continued ability to use fracking, fracking is not new, we've been doing it for 25 years, but with the technologies we are not only able to get the gas out of the shale but very economically. Jipson said. “And so as a result of that you know what an abundance of natural gas that we've never had before."

Additionally, U.S. natural gas production has grown over 20 percent the past five years and the world's usage of natural gas is about 24 percent of all primary energy consumed. Oil is approximately 33 percent and coal's is 30 percent.

"We can now look at natural gas beyond just space heating and water heating we can look at it for enhanced power generation, continue building more and more plants on natural gas, its a backup to all renewable energy and at the same time we can use it as natural gas transportation," Jibson said. "We can do all this and even look at exporting natural gas. Six years ago we were considered an importer, now we are looked at as an exporter of natural gas."

Questar Corporation, based in Salt Lake City, Utah, is a natural gas-focused energy company specializing in retail gas distribution, interstate gas transportation and gas production, which are conducted through Questar Gas, Questar Pipeline and Wexpro. Jibson believes this rapid shift in the natural gas supply will also transform the natural resource's role as a "abundant foundation fuel" rather than a "bridge fuel." With saying that, Jibson recognized the reality of using all forms of energy.

"Now it probably is not a great situation to have just one fuel be a foundation fuel," Jibson said. "So as people talk about natural gas being that foundation fuel, which we believe we have the abundance for it, but we also have to be cognisen of we need a large portfolio of many supply, and that includes the development and better technology in all the area."

U.S. Senator John Hoeven (R-ND) agrees with Jibson on the importance of a balanced energy portfolio and sees North Dakota's long term approach to natural gas as the role model for other shale plays.

"We are producing huge amounts of natural gas which really is a byproduct of our drilling for oil," Hoeven said. "But the key is we have to capture it rather than flare it and get it to market. Part of that is creating a market for that natural gas."

Hoeven’s drive for the Bakken to become the poster child for the energy economy has some validity. North Dakota has multi-billion dollar natural gas investments from ONEOK, Hess Corporation, CHS, BNSF, and Badlands, LLC. Turns out this is just the beginning of the billion dollar announcements.

"We are working with Cenex Harvest States to build a multibillion dollar fertilizer plant," Hoeven said. "Right now that fertilizer has to come from India, getting shipped across the ocean, hauled to North Dakota on trains. We are at the end of the line creating costs and questions about dependability. Think about producing it here. We are just barely scratching the surface here."

Hoeven is not alone when it comes to lobbying for a shale play’s place in the history books. Matthew D. Cabell, President of Seneca Resources Corporation and Senior Vice President of National Fuel Gas Company, sees the Marcellus Shale as the one to set the standard.

“The Marcellus Shale is arguably the most important natural gas accumulation ever discovered,” said. “Along with several other shales, it completely transformed the energy landscape in this country.”

Seneca, the Exploration & Production subsidiary of National Fuel, produces oil in California and natural gas from the Marcellus Shale in Pennsylvania.

Loren Scott, an energy and economic expert, believes Louisiana is poised to shift into natural gas overdrive.

“Number one, if you go New Orleans to Baton Rouge over to Lake Charles in the Southwest Corner, that’s the I-10 Corridor, along there you have the three things that chemical firms need. You need lots of water, and you have the Mississippi, the Gulf of Mexico, Calcasieu ship channel to Lake Charles. You need a way to move bulk product, which most of these chemical firms are moving bulk products, again barge is the cheapest ship and way to do that and you have the river,” Scott said. “Number three is you need lots of natural gas and we have lots of natural gas. So even before the recent boom Louisiana was number two in the nation in terms of chemical production. Second only to Texas. Texas has those same three things that I mentioned. But now what is going on is you are having a huge industrial expansion of all those firms and brand new firms coming in and the reason for that is because they are huge users of natural gas. So what is happening is the U.S. share of the world’s chemical market is growing because we are kicking the behinds out of the Europeans. They can’t compete with us when they are having to pay $12 per million BTU for natural gas. So there is in Louisiana today about $104 billion with announced expansion.”

Scott added the Wolfcamp in Texas carries the biggest potential for oil companies' reallocating resources and restructuring their strategies due to the shale play’s massive size.

“The Wolfcamp is huge. You’ve heard of the Eagle Ford, but the Wolfcamp is thought or estimated to hold 50 billion barrels of oil. The Eagle Ford is 27, the Bakken is 13 billion,” Scott said. “The Wolfcamp is second only to Ghawar Field in Saudi Arabia in terms of size. This sucker is 3,500 to 4,500 feet thick. It is hot with oil.”

Dr. Scott is President and Founder Loren Scott & Associates. He was on the Economics Department faculty at Louisiana State University from 1969 to 1998. He is presently Professor Emeritus of Economics at LSU and public speaker on energy issues.

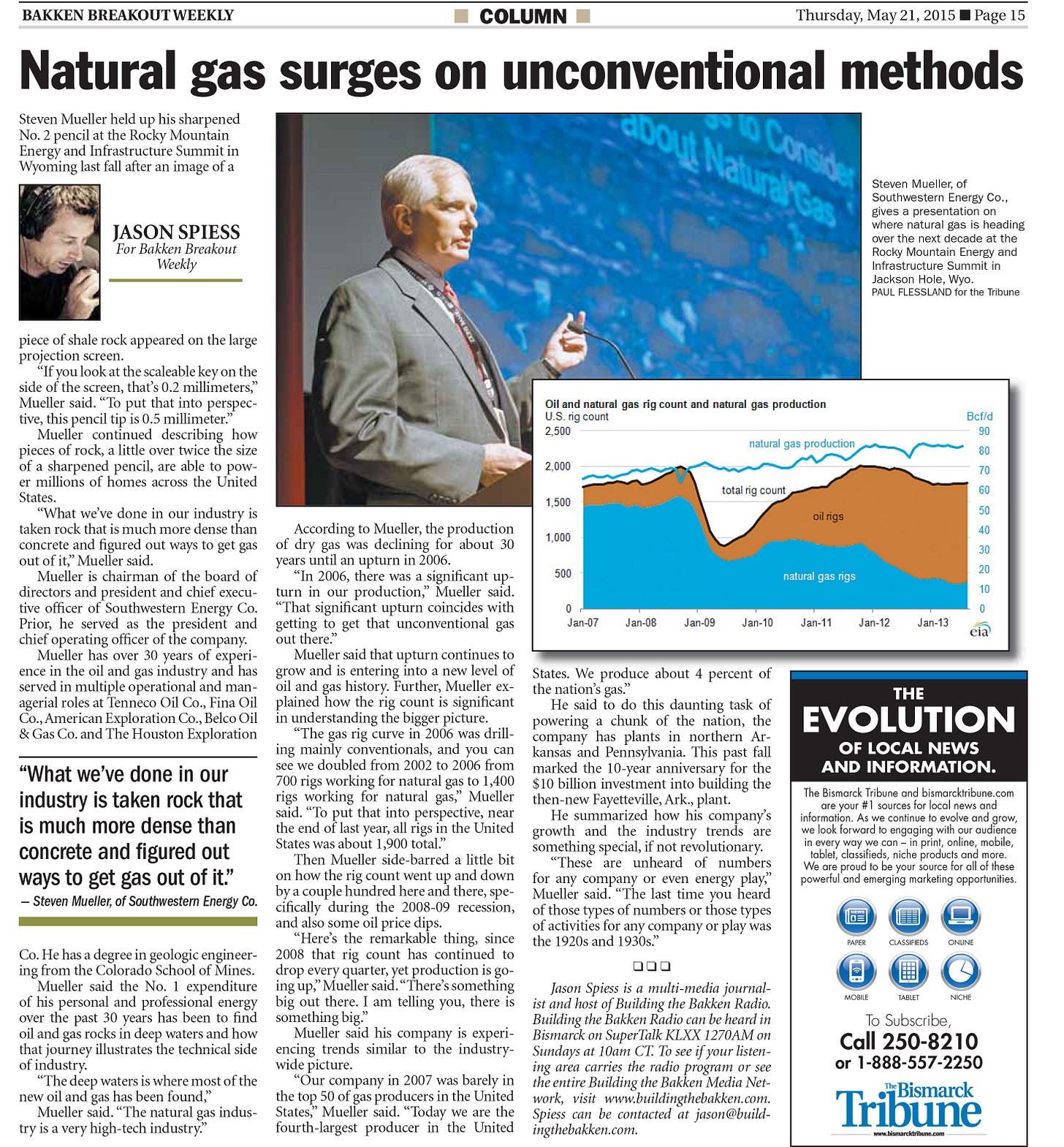

Current market conditions are off the chart to the tune that the U.S. has surpassed once global leaders Russia, Qatar and Iran in production gains. The capturing of natural gas, as a by-product to the massive shale expansion, seems likely to continue its prodigious growth in the Marcellus, Barnett, Bakken and other gas-rich shale plays across the planet.

Qatar's natural gas production is something Ken DeCubellis, CEO, BlackRidge Oil and Gas, is familiar with, giving him an edge at understanding the current state of natural gas in America.

"I used to work for Exxon Mobil. And in the early 2000’s into 2006, Exxon was worried, as was the rest of the country that we were running out of natural gas here. They embarked on a multi-year program investing about 30 billion dollars in the Middle East, in a country called Qatar, to get access to the natural gas in Qatar, liquefy it, ship it over to the US, regasify it offshore and get it into the grid," DeCubellis said. "Thirty billion dollars. OK. Now what Exxon is trying to do is take all the natural gas that we are producing here in this country and export it. So they are going in the opposite direction. Two drivers behind why the energy situation has flipped completely on its head in a short period of time. It’s the advent of horizontal drilling and hydraulic fracturing. And it’s the combination of those two which is very technology focused that has unlocked this potential."

The one slice of this natural gas play that has many investors excited, and worried, is natural gas transportation. Jerry Moyes, founder, chairman and CEO of Phoenix-based Swift Transportation, one of the largest trucking companies in the nation, is in the initial stages of investmenting into converting their trucks to LNG.

“We run about 20,000 trucks and run about seven to eight million miles a day,” Moyes said. “We’ll buy about million gallons of diesel fuel a day. Swift will gross about four billion and a billion of that will go to diesel fuel. It’s a very big number and is something we are really watching.”

Moyes estimated 200 trucks would be running on natural gas by the end of the year. Issues and potential solutions were addressed in a variety of areas including a lack of national infrastructure to energy price points to vehicle weights.

“I told the Wall Street Journal last year I was hoping to be ten percent natural gas by the end of this year,” Moyes said. “I’m probably going to be at one percent.”

In addition to uncontrollable variables in distribution, engine technology and energy prices, Moyes said they are going through a learning process as their research and development continues with natural gas conversions for a bigger payoff down the road.

“Once we get into the next generation of trucks we won’t be spending that much money,” Moyes said.

Moyes is also owner of charter airline Swift Air and a limited partner in the Arizona Diamondbacks, and was once a minority owner of the Phoenix Suns.

Looking at the nation's other distribution backbone as an indicator for trends, Tom Petrie, president and chairman, Petrie Partners, said companies like BNSF are extremely interested in natural gas technologies because of the significant cost savings.

"We are in the early stages of the railroads testing their LNG as a product for their engines," Petrie said. "They are under a lot of pressure because they have to run ultra low sulfur diesel. One thing we learned about ultra low sulfur diesel is it is a lot easier for Congress to pass a law, or the EPA to pass rules mandating it than it is to do it."

Petrie said the price of diesel used to "sell for about seventy-five cents less" than regular gasoline, whereas now diesel sells for "about a dollar more." Petrie claims this is because of ultra low diesel standards.

"Natural gas is selling for about $24 dollars an equivalent barrel, versus a $104 dollars a barrel," Petrie said. "That's a huge spread to work with. Now the question becomes will the performance be up to the standards of BNSF's needs for their engines, they're doing the tests on them right now."

Petrie added the shift to natural gas, in theory, will lower the cost of the natural resource and improve environmental practices.

According to Jipson, the current roadblocks being experienced in country’s distribution backbone haven't stopped the industry’s shift towards natural gas.

"Again, because of the abundance of natural gas you now have what I would call the foundation market which is your midsized vehicles," Jipson said. "These would be your trash hauling vehicles, your busses, commuter shuttles, and so forth. Places where the economics are a flat out no brainer. They are seeing tremendous savings, again the abundance of natural gas makes that possible."

Jipson pontificated that America's transition to natural gas trash hauling vehicles may shift quickly over the next two years, indicating 70 percent is "very likely." He continued saying the most current numbers he saw in the trash hauling vehicle niche was approximately 49 percent.

"The medium, mid-sized vehicles, the transit busses and so forth, are definitely the foundation of this shift. The large vehicles, the big semi trucks, are now what I would call the emerging market. We are seeing tremendous results from companies like Swift Trucking and Central Freightlines, major companies like Frito Lay and Dart Transportation who have made major commitments to convert large number of vehicles, who are buying the engines currently available in a 12-liter engine. We are seeing the trucking industry really take hold of this."

Jibson said costs are being reduced and major milestones and hurdles have recently been addressed.

"All the little issues are being resolved that were there originally," Jipson said. "For example the issue of where to fuel. We are out building those kind of facilities in the right locations. How to fill. We are seeing the filling times of natural gas, both CNG and LNG, are it filled as quickly as diesel into the trucks. The drivers love them and companies are starting to move that direction."

"I think truly in the United States, we're seeing, finally, the needle move to a point where I think we are going to be very competitive in the rest of the world and we will see this market continue to grow and develop."

Jipson offered an update on the direction of passenger vehicles too.

"Passenger vehicles are probably the market that is being pulled along right now,” Jipson said. “I think we are going to need to see home refueling at a very economic rate and technology, there are devices currently available, but we need to get the price down on home refueling units. When that happens I think you will also see the passenger market also take off."

Home fueling stations are exactly how it sounds.

"These units are attached directly to the home natural gas system, does not take any different pipelines, doesn't take a different service line in the home, it just needs to be tapped into it," Jipson said. "They are slow fill. So the concept is with a lot of the new vehicles being introduced by Detroit, we are starting to see passenger vehicles that are dual fuel."

Jipson said the majority of the miles American's put on their vehicles are commuter miles.

"So the philosophy is that you have a vehicle, that say has a 150 mile range on natural gas, people can drive to work everyday, they come home and plug-in in their garage, by the next morning they have a full tank again ready to go," Jibson said. "If they decide to drive outside the range of a natural gas filling station on the weekend, they can run on the gasoline in the dual fuel vehicle. It's a great philosophy and can be done right on their home unit."

Jipson said many natural gas utility companies can supply, install and maintain these units. The charges vary depending on region and amount of service required.

Jipson added it is an exciting time in America and the transportation transformation is happening.

"We are very excited to be a part of that," Jipson said. "We are building these major facilities, literally from the West Coast to the East Coast in strategic locations. A lot of cities many people haven't heard about, but they are major hubs for major trucking companies and we are going to see that market continue."

(Interview and article from 2013)

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

Email your sustainable story ideas, professional press releases or petro-powered podcast submissions to thecontentcreationstudios(AT)gmail(DOT)com.

#thecrudelife promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

CLICK HERE FOR SPECIAL PARAMOUNT + DISCOUNT LINK

Paramount+ offers its subscribers a plethora of quality content.

From classic films to banger TV shows like 1883 and Star Trek: Discovery, there’s no shortage of entertainment to explore.

How about some cult favorites like Red Dawn, Grease and There Will Be Blood?

Start Streaming Today!

Share this post