The Crude Life founder Jason Spiess interviews former North Dakota Governor and then-Continental Resources board member Ed Schafer about how important technology is in the Bakken oil boom.

His answer prompted us to ask other industry experts whether the Bakken was a tech boom. Schafer said the current technology is only getting about 5% of the oil out of the ground, and as the technology improves, more oil can be extracted from the ground.

Below is the Artificial Intelligence Transcript, there may be some errors in spelling and names.

Jason Spiess

Well, what, what are you doing these days? Let's, let's start with that. Where, where you're at? Of course, former Governor of North Dakota, uh most uh known person for uh working with oil companies, kind of bringing the oil companies to North Dakota. But since then, what have you been doing? Well,

Ed Schafer

you know, it's, it's um always busy times and there's so much to do Jason there is you never have to worry about filling up the calendar. But, uh you know, I am such a fortunate recipient of North Dakota's wonder and natural resources. I get to work in the energy and agriculture fields and um I, I travel around the world, speaking on energy and agriculture policy, I'm serving on some corporate boards. I have a couple of uh environmental and preservation projects going on out in the

east coast, like the Chesapeake Bay watershed cleanup project and uh and things like that. Plus, um now I'm getting involved with uh a governor's group on uh pursuing funding for the National Transportation uh Trust Fund, uh which seems to be run out of money like everything else. And uh you know, the importance of uh of infrastructure development in States is a big deal and we're engaging governors in that, uh, in that, um, effort to bring funding to the Highway Trust Fund.

Jason Spiess

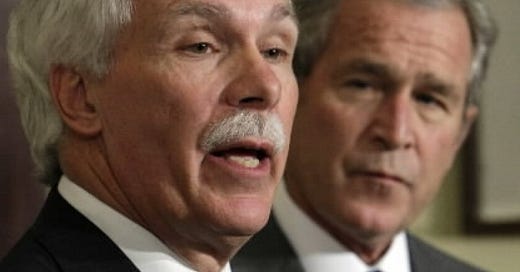

And you served as a secretary for the United States under George Bush.

Ed Schafer

Yes, I was the Secretary of Agriculture USDA at the end of the, of the George W Bush administration. Uh The

Jason Spiess

reason I bring that up is, um, you're well known for a, as well and as you're becoming very known as for energy. But the um event down in South Dakota with the cattle, this is side here, but we are out in, we are out in Sundance Wyoming. Um At what point does that become a federal emergency? Because here in North Dakota, we have flooding and we get federal emergency dollars. All Tom Tom, that cattle situation seems like a pretty severe

Ed Schafer

situation. Uh It is a severe situation and, and it's a tough one. We went through that in 1997 1998 winter in North Dakota where we had many, many, many cattle die and it's just this mass die off is a very difficult issue. Um The, the process of getting the federal emergency declaration is an application for the state. Uh There has to be a survey done and there's a percentage of damage to, um, to, um, the, the, I don't know what the measurement is.

There's a percentage of damage to the population or the county or, you know, the, the amount of economic activity or something, there's a threshold and if you meet that threshold, um, uh, not something you want to do, you know, but if you meet that threshold by the amount of damage that takes place and you have to assess that damage in a certain way, um, then the federal government can declare the president apply to the president to declare, um, a federal emergency.

And the federal emergency then allows you access to federal funds, uh small business loans for recovery, uh certain loans and grants for, for um reclamation and things like that.

Jason Spiess

And so I apologize for the building to and listeners just didn't want to let that opportunity escape. When we have the former egg secretary here on the program pad drilling. Let's transition back into energy for a second pad drilling has really changed energy exploration. Recently, I was reading, I believe it was continental decrease from 13.9 to $8.3 million per drill pad.

That's incredible savings. And of course, corporations, when they allocate money to spend in the state, they're going to do that. So when we see those savings happening, of course, that's more money for the state and it helps for the economy. What do you on pad drilling?

Ed Schafer

Well, pad drilling is great uh continental resources, call them echo pads and they are echo pads. They're, you know, they're, you look at the, you know, ecology of extraction and the opportunity to shift. Now as we, as we shift in the Bakken from the discovery phase into the operational phase. Now that the mineral rights been secured, the borders have been um outlined.

Uh Now you go in and say, oh, how can we be more efficient? How can you do better? What can we do? And I, you know, the, the energy industry often gets a real bad rap on, on the environment and things and, and, uh I, you know, I like to point out that the, uh the Minneapolis Fed Board took all their people out to the, a few months ago and they were kind of like blown away at the attention to safety and environment that the oil companies do and those echo pads, uh or the pad drilling, you know,

allows you to put uh a number of holes and in some cases, you know, more than 10 in the same spot. So you're, you, you know, you reduce the truck traffic, you, you have less holes in the ground, I guess you have the same number of holes in the ground with it all in one spot. But, but, um, you know, the, the in and out traffic, the opportunity to have one uh economic, one, environmental impact on one pad versus spreading 10 wells out over the countryside.

You know, those kinds of things have made a huge difference. And it also, um, as you mentioned, uh allows the oil companies to reduce the cost of drilling. Uh Some of that reduction is coming from just now as you get into the operational phase, things slow down a little bit. You start paying more attention to cost, you start, you know, pushing down on, on, um, uh things that you really care about or couldn't care about before because it was just, the activity was so strong.

But, but the, but the eco pads are, you know, reduced cost better for the environment and really uh better production for the company. So, you know, it's really a good way to go

Jason Spiess

extraction tax. Let's talk about that for a second. You led a campaign a number of years ago. Um educating the public about the extraction tax in North Dakota. It went to a vote I believed with the legislature or it didn't make it through the session. That's what it was.

It's coming up again. And I want to ask you something because I had a conversation with an executive for an oil company and he brought something to my attention that if the price of oil drops to a certain dollar, the taxes are on a tiered system. Are you, can you comment

Ed Schafer

on that uh in North Dakota? Um because our extraction costs are high, the oil is deep and we recognize that the cost of getting that oil out of the ground are more than other states. We have a, we have a trigger mechanism when the price of oil drops to a certain level, the extraction tax will also drop to try to keep you to keep that activity moving, to keep, to keep things, keep that oil pumping.

Because at a certain price point, oil companies say, hey, you know, it's not, it's not economically viable to produce these, this oil in North Dakota. So they, you know, they cap the wells and they quit, quit drilling and, you know, then we're sitting there with a huge resource that we can't tap into because

Jason Spiess

they, they hold it underground, what better place to start from the ground.

Ed Schafer

And once you, once you discover a well, uh you put that asset, uh you, you, you know what you call, prove the well and it's an IRS term but you prove well, you put the asset on the, on your balance sheet and you can borrow against that money. I mean, you borrow, you borrow against that asset and then you go drill your next wealth, you know. So it's, it's a way, especially with the independent folks.

Um you know, it's a way that you capitalize the way you raise the funds to be able to explore and, and uh produce the oil that's in the ground. So that tax element is important in North Dakota does have a trigger mechanism that lowers the tax when the oil gets below a certain price.

Jason Spiess

Um If the price of oil were to go down and that trigger point were to happen, say in the next year, just throw this out there for hypothetical, um, what would happen with the State's Treasury because there's a lot of dollars committed to a lot of towns, albeit Fargo, Bismarck, Dickinson, Williston. Um, I, I, I don't know if these conversations are being had, I don't know if people are running away from this conversation, but when the one I had with the oil executive was real and it got

me thinking that, you know, Di Dickinson's $100 million in debt and they're, and they're expecting 43 million from the state. What would happen if those triggers? You know, you see what I mean? Yeah.

Ed Schafer

Well, I do see what you mean. I, I, I think, I think, um, you know, when you, when you look at that, um, the, the production situation in North Dakota, we're a little, we're in better shape than when this happened to us in the seventies. You know, in 1979 the price of oil peaked in the production in North Dakota virtually stopped. And, and when that happened, a lot of communities, um, got caught with infrastructure that they developed and now couldn't pay for and, and it was a very, you

know, property taxes for 10 years and Williston went backwards to pay for investments they already made instead of going forward to invest in your community to grow. You know, it was a very difficult situation. Um, we we are a little tempered with that this time around because now as we push a million barrels of production per day, um, if the costs go down, um, or, I mean, excuse me, if the price goes down, um, you may not see the drilling activity, but it's unlikely that the

production activity will slow. So, you know, they're not gonna go in and cap a well. Um, in the, in the seventies, they went and capped wells because the price was so bad. Um, you know, $10 a barrel. Um, and, and, and less in some cases. So, um, you know, you just couldn't afford to take it out so they can't.

But now we have the, we have the capacity and the volumes in North Dakota to where it's, it's unlikely unless, you know, unless you get back down to a $10 a barrel oil, uh which you always can. But, but we were there five years ago and we were there less than five years

Jason Spiess

ago. I mean, think about that though, 55 years ago, nobody was predicting $100 oil and $100 oil came and that allowed a lot of this activity to

Ed Schafer

happen in, uh in uh 2009, you know, the, the commodity prices of oil were just in the tank, you know, and, and it's a volatile industry. It's a, it's a law of supply and demand, it goes up and down and that's kind of what you do you worry about getting trapped with. And one

Jason Spiess

that's why we're having this conversation. And

Ed Schafer

one of my concerns is that we have built such a dependence on revenue um from the oil industry. Um, you know, 35% of our budget, our state budget comes from oil revenues. Um and not only, not only oil revenues, but the oil activity produces sales tax, vehicle tax, license fees, you know, all these kinds of things and huge amounts of dollars are coming into our budgets and should that oil activity slow or stop?

Um, we have a problem. We did it, we, we've overbuilt our government in, in, in the 19 seventies, we got hit in the eighties, both with agriculture and energy. Uh, on a down side of the economy, it hurt our state for 10 years to be able to, you know, kind of get out of the mess here and, and, and get the budgets back in shape and get the, get the state moving.

Um, we could do that again. I mean, we have to be very careful not to get it so far out here on oil revenues that when they do the, the always cyclical nature of the business when they get into those down cycles, you know, we don't wanna have to shut down our government. Uh,

Jason Spiess

Jack, are you familiar with that name? Jack? Uh, Jack was part of a panel at the North Dakota, uh, gas and oil and gas producing counties annual meeting in Dickinson with a number of oil executives and Jim Art from M B I moderated it. And from that meeting, there was a story that came out of there incorrectly about how Jack Trom said he wanted the extraction tax cut in half or they were gonna leave and go to Colorado.

Are you, were you familiar with that story? Ok. I was at that meeting, that was the furthest from the truth. Uh Jack was talking about how North Dakota has one of the higher extraction taxes in the United States. True or false. And what he said was from what I heard, if the public doesn't see the investment being done in the infrastructure, they're going to get upset.

And also we know you have some wiggle room whereas Colorado is starting to look more appealing every day. What, what do you make of my analysis of that meeting in comparison to White V P wants oil extra oil extraction tax cut in

Ed Schafer

half? Well, there, there are a number of elements in that question that need to be addressed. First of all, the infrastructure, you know, in the western counties or in oil impact counties, you know, is tremendous. The state legislature put two 0.5 billion $2.5 billion into infrastructure development in western North Dakota. That's more money than they can spend.

You can't get the equipment and the, and the, and the workers and the, and the inputs and the gravel and the asphalt and, you know, to, to do the things that they need to do. So they, they have more money than they're able to do. The reality is we're playing a catch up game. We were behind the curve as the, as the production accelerated so rapidly.

And one of the things we have to remember now is as we move out of the discovery phase into the operational phase, things calm down the activity level lessens pipes go in. So you, you lessen the truck traffic. Um, you know, all the potholes and the bypasses and all that kind of stuff, you know, get put back in place because you can't, you know, we're starting to catch up on that.

And I think one of the problems that we have is the western counties are kind of not seeing that bell curve of activity right now. They're thinking that the activity is going straight line going up and they'll never, they'll never get caught up. So they're panicking and saying we don't have enough money. The reality is, you know, the, the citizens of North Dakota through the legislative process have supported those counties hugely in infrastructure development.

And now this, now the communities get a chance to catch up and it's kind of like, well, we have to hold our breath until we get there, but we're gonna get there. And, um, so, so, you know, that's an important message that western North Dakota and really our whole state needs to understand that we're not letting those counties dangle out there.

They're not just being, you know, thrown to the wolves and let, let production of oil go and be damned. Um, you know, this is important investment and it's happening. So, so in

Jason Spiess

your opinion, the amount of, um, investment with the tax dollars being put into building of infrastructure is, is pretty good. I mean, you feel ok with that.

Ed Schafer

Well, you never have enough money. You know, nobody has your, especially when you're dealing with government revenues, you always want more, right? But if you look at a part of the extraction tax goes directly to back to the counties, another part of it goes into the state coffers and is allocated by the legislature back to the impacted counties. Um, you know, so, uh and uh they have their own revenue sources. So, you know, there, there are, uh uh again the local control over the

amount of money being spent and the priorities on which they're spending it now is an important issue and the priorities right now should be infrastructure, uh impact things, you know, I, I kind of wonder Williston is building this huge, huge civic center and, you know, is that a, is that a priority versus, you know, fixing their roads and bridges or, or, or, you know, what, what $70 million? Well, it's, you know, it's the biggest one in the state. But, but I mean,

Jason Spiess

realistically that's $70 million going into a community and it's going into one building. Is that viable investment? That's, that's a fair

Ed Schafer

question. And I think the point is if, if you, if you look at, you're never gonna have enough money, you're never gonna have all the money in the world. Um, so you've got money coming in. What are your priorities? You know what, what are the priorities of a community? If you can't have it all, let's do the most important things first instead of trying to do it all and then saying, we don't have enough money, you know, and I, I think that those, those are the important movements that

we're gonna see in Western North Dakota now. And local officials, mayors and county commissioners and city commissioners are going to have to start saying we have set priorities here. We have to figure out how to pay for them. And certainly, you know, we're bonding all this stuff.

We have to, we have to remember in a cyclical industry that we can't get caught with the downturn in the economy, in our community and then not be able to pay for the bonding and the things that we're doing right now. So

Jason Spiess

let's talk about the downturn for just a second. Are we setting up small business owners in North Dakota right now with the investment we're putting, what I mean is N Ds U has a catering department and they compete with local catering companies. Dickinson is talking about selling more water to oil companies. Last year. On program, I had a, had a officer on from the reclamation department and they were talking about selling water from Paterson Lake to the oil companies.

How much of governments gonna compete with small business? I guess I'll be very blunt with you about that because you know, you, you mentioned $70 million infrastructure in Williston, they gotta keep that going after they build it. So are we setting up small businesses here?

Ed Schafer

Well, unfortunately, uh when you have a whole lot of money, Jason people sit around and try to figure out how to spend it. You know, you take care of the needs and then you say, ok, well, we have some left over. How can we spend it and legislatures efforts are to solve problems? I mean, they, you know, they've got a problem in the community, they worry about it.

They say we have some, some tax dollars here. How how can we use those to solve problems as you have too much money in a bag. Often legislators and governors, you know, will say, well, let's solve the problem with tax money and sometimes that problem should be solved with the private sector. But instead of encouraging the private sector, we put tax dollars in.

And one of the perfect examples where I think the State of North Dakota is making a mistake and competing with the private sector is in what you just mentioned, the water delivery, you know, we've allowed the set up of the western area water supply project, which is clearly in competition with the private sector. And you allow people to have, you know, grants no taxes, low interest loans, not people, but the communities that can, that can build a water supply project for what a

third of the price that the private sector can do it and then go in and compete with them. Well, that just isn't right. Our country, our state, you know, we're built on private sector investments with government encouragement. If we start getting into, let's have government run the businesses. Let's have government compete. I think it sets us up for a big problem in the future.

Jason Spiess

Final question for you here. I appreciate the time today. Former Governor Ed Schaffer of North Dakota, currently a uh Continental uh resource board member. Is that the correct way to

Ed Schafer

phrase it? How I sit on the board of Directors of Continental Resources? And

Jason Spiess

uh the Tyler, let's talk about the Tyler uh uh 22 questions. Sorry. First one is state rights and the role of an E P in this energy boom. And then uh the Tyler, if there's any update on uh Continental and the Tyler,

Ed Schafer

then we should get back to the tax, the tax too because we, we skip that.

Jason Spiess

Did you have time Well, it's um yeah, I just wanted to make sure we're, we're about

Ed Schafer

ok,

Jason Spiess

let's um, let's do the tax, let's continue with the tax then and then we'll get

Ed Schafer

that. Well, you, you know, you mentioned the impact of what our extraction tax is and, and oil company representatives are saying our taxes are high as, you know, the highest in the, in the lower 48 states. Um I think the important thing to look at there is how we started this play in North Dakota. Um In, in the, in mid 19 nineties, you could see the Bakken start to develop and all of the drilling, all of the activity was in Saskatchewan, not in North Dakota, we had one rig drilling in

North Dakota because it was more expensive to operate here. Not that the tax level is right of this, that when you started looking at, where do you develop? It was more expensive here. So we in looking at that lowered the extraction tax. The legislators governor being me, you know, pursued the lowering of extraction taxes in North Dakota for the new technology of horizontal drilling and horizontal drilling.

What was, what is, what unlocked the potential of the natural resources in the bak and play. And so we, we proved that lowering the taxes at the time cause the shift of activity to move into North Dakota that was across our borders previously. So if you look at that and say, OK, the, the cost of extracting that oil um is an important factor in where people drill.

Then you have to recognize that, you know, now our technology that we've developed in North Dakota, which was marrying the, the hydraulic fracturing with horizontal drilling is being used in Texas and Oklahoma and Colorado and Wyoming. Some places in California and foreign countries too, foreign countries too. Uh They're, they're really not going to be competitive with us though, however, on a tax basis.

So, but, but Colorado is Wyoming is, and if you own the mineral rights and you, and you've got a 25 year stream on those and you don't have to drill a well there. Why would you, if it cost you more? Now, in the beginning, in the discovery phase, you do because you want to get, you have to get that well drilled, you have to secure the mineral rights, but once they're secured, you have no need to drill for that oil in that mine, right patch.

So instead of drilling the 2nd and 3rd and 5th, well on that same area in that same pressure field, um you drill it in Montana or you drill it in Wyoming and then 15 years later, you can come back and get it out of North Dakota. So you're gonna, I mean, the, the, the capitalistic system, you know, the law of supply and demand, you're gonna say I'm gonna drill where I have the least cost And if you look at the drilling activity in the Eagle Ford play in Texas, we have twice as many rigs

drilling down there than in North Dakota right now. You know, if you look at, if you look at the new activity that's going in, it's going in Central Oklahoma, it's going, you know, Colorado is kind of peaked out a little bit, but you're starting to, you know, of course, see Montana now, you know, pick up in the and in some areas uh in Wyoming. So I just think we just need to be careful there because um we have higher costs and we, and we must remain competitive.

Not today, not tomorrow, but, you know, in 2015 or 2016 or somewhere along that line, if we're not competitive, we'll start to see a lowering of activity. And we've had, you know, previous comments here about how lowering of economic activity through the energy can really hurt North Dakota, our communities and our state.

Jason Spiess

I'm seeing signs, right? No, I, I went down to be and, you know, the, the, I don't know if you've been down there, but they're right in the center of this whole energy boom because uh they've got uh I 90 and they've got uh highway 85 2 12, they get 9000 vehicles a day going through this little intersection because it's on the way to Cheyenne Wyoming or Gillette.

Sorry, Gillette. And you know, Gillette's like an energy boom town, but I'm seeing Permian tanks set up shop there and now I'm starting to see tanks sitting outside at Fargo Tanks, which didn't happen before. It's almost like they're setting up kind of that middle area in case of the Colorado play. And these, these new pad drilling they're paid for in 18 months is my understanding and they can, they can take them down and set them up in four days.

That's how efficient the oil industry has gotten. So I do think there's some legitimacy right now and it's not a threat as much as, hey, guys, listen to what we're saying. I don't know. That's what I think is coming out of the, the oil companies. It's not a threat like it's being framed in the

Ed Schafer

media. No, it, you know, people are always threatened if you say, oh, you have to lower the big bad oil companies taxes because they're rich and they make all this kind of money and this and that the reality is they're going to extract our mineral resources where they can do it the most efficiently in the least cost manner. And we just have to be aware of that in North Dakota because, um, you know, oil companies were 35 years out, you know, they're securing mineral rights, they're

moving rigs, they're getting capital, they're, you know, they're planning on where they're gonna start punching holes. Not today, not tomorrow. Three years from now. Five years from now. And in North Dakota, if we're not gonna be competitive three and five years from now, um, why would you drill there? Why would you, you don't have to. And, you know, the reality is you use, you have a declining reservoir, you drill a hole, 85% of that oil production.

It disappears in the first three years and then it settles down to, uh, you know, to a manageable production level for the next 20. But if you don't keep drilling holes, you can't keep the production up because of the, because of the declines. Well, if you don't keep drilling holes, we don't keep revenue in North Dakota, we can't feed the cost of our government through energy. And we just, you know, I, you know, I, I, I believe, you know, we ought to be aware of our extraction taxes.

It worked in the nineties for us to lower that, to create activity. There'll come a time in North Dakota where we're gonna have to create activity by lowering the cost of doing business in North Dakota. We recognize that already by having a trigger point if the prices go down. But what we're not recognizing is the competitive aspect of other oil plays around our country. And we just need to put that on the table you

Jason Spiess

mentioned Canada. And there's a prime example I was talking with uh uh target logistics and they get like subsidies in Canada. They're welcomed in with open arms for this type of crew camp housing. Whereas in North Dakota, they're kicking them out and there's regulations here. I mean, it, it, it was an example he gave of the two point of views when it comes to energy exploration and energy production.

And they wondered why the United States hasn't gotten on board with that. If that makes sense because, uh, because of the, the, the jolt in the economy it can give and if spent wisely, you can really like, uh, like what Dickinson's done with their, their infrastructure, they have five LA now going out of town. It's, I mean, it's like a comfort cruise lane going out of there, man.

I mean, it's, I, I, I've never experienced anything like that before but um, what, what, what, what do you want people to remember about the extraction tax? Because when it first came about, I did think it was oil companies looking for more money and then I kind of did some research and, and uh, of course, I'm a, I'm a writer as well. So it, it helps for me for research reasons, but I realized this is real, this is legit and they're not trying to be the big bad wolf.

They're trying to be the town crier. They're trying to be on a soapbox saying, listen guys, this is real. You, you need to understand that there's a competition out there and we've become more efficient with how we're doing things. I don't know. I just, what, what, what do you want

Ed Schafer

people to? Well, I want, I want, I would like people to remember that. We jump started the energy industry in North Dakota in the 19 nineties by lowering extraction tax so that we lowered the cost of that drilling. So that activity mine, right, purchases, capital raise equipment moves, started to come into the state and we started to see that activity go as that activity started to move.

That's great. We started getting revenues in and we started to spend our revenues and, and it's really benefit this the whole state. I mean, we're sitting in Fargo right, right here now and oil extraction tax is buying down property taxes right here in Fargo. So, you know, the, I mean, the whole state has benefited from this thing and, and rightly so people say get it while you can take the money, you should raise the taxes.

So you get more those kind of things. The reality is in the private sector, market places in the United States of America, the foundation of this country and the foundation of the economy in North Dakota. Um It's a competitive, you know, uh investment and where you can make the most money to satisfy your shareholders, your bankers, your owners, um and uh and your, and your suppliers and all those kinds of things um that we, that we want to do.

So, you know, you take care of your employees by making money and, and so we need to remember that, uh, that we need to remain competitive that, you know, we're not saying, boy, we should just give the, the, the oil companies more money. Um How do you handle this whole thing? The reality is at some point in time, if, as we saw in the nineties, the activity was across the border and we could do something about it to get it inside our border.

We, you know, we, we have to, we have to take that into consideration and say, do we want to be competitive? Do we want the activity here? We proved it works in the nineties. It'll work again the other way if we're not careful. So, you know, let's be careful about that. The other thing I think it's important to remember is that, is that oil companies are making plans 3 to 5 years from now, not today.

And so, so we have to anticipate when this shift of competitiveness comes so that we're not sitting there and saying, oh, well, we have to do it, you know, we've lost our revenues and by the way, we've got to put it back in place today because it doesn't come back at the snap of a finger. Legislature can't lower the extraction tax and expect the next month to see activity increase. It is years out before you can generate the opportunity to bring that business back you know, let's,

let's be aware of the competitive situation. And let's remember that we have to, you know, it's kind of like when you're shooting ducks, you shoot ahead of them, you know, you don't shoot them, you shoot ahead of them and, and uh, you know, we have to make sure that we're out ahead of this thing as we look at the extraction tax costs, extraction tax costs for North Dakota because we could get caught in a situation where we have a dip in revenues that could hurt us.

Jason Spiess

You know what I love about this energy boom. And I've done some research and it's like with most energy booms, it's a, it's an inventor's backyard paradise. I mean, they come up with some new flange, some new flange system, for example, that's piping. I guess it can be an overnight millionaire because an oil company will put it on all, all, all the rigs overnight. If it works out, it makes their business more efficient. The there's a lot of that going on where, where, you know, oil

say somebody's working for marathon oil. There you go, one of your competitors. And he, he's taking a look at this pipe every day and he looks at it and he goes to his boss and his boss says, well, I want you to design something. He goes out and gets a pat. And next thing, you know, this guy is doing business with marathon as a as a, as a rep now, as an inventor that's happening a lot, isn't it?

Ed Schafer

Every day I get the opportunity to see, you know, some kind of a new project, new company, new way of doing business, new technology. Um And, and it's in, it's in, in all areas, like you said, you know, it could be a flange on a pipe. It could be the way you measure something, the way you distribute something, the way you seal something. Um You know, it's just, it, it, it's amazing and it is an inventor's paradise.

And the economic activity is what creates that. If you, you know, it's, it's, it's the, the, not only the extraction of the natural resources is the extraction of the money, it's the extraction of the economics that people say, you know, if I could sell 52 of these things, I can make some money and, and that economic, that economic activity is what allows you to invent those new products to get them tested and built and get them out there

and get them sold. You know, it's providing tremendous opportunity in North Dakota for new companies, for new ideas, for new technology. I, you know, it's, well, I tell you

Jason Spiess

some of the inventions are, are neat as far as pulling um pulling metal out of pipes with, with magnetic blankets around pipes. I mean, something as simple as that every day. It's just,

Ed Schafer

wow, that is really a cool idea. You know,

Jason Spiess

then you also are seeing a lot of uh innovation in flaring happen. I mean, we, we just had the uh alliance pipeline open up. Uh He is scheduled to come on board in the next several months and to satisfy some of those natural natural gas flaring problems. Where is continental with natural gas these days?

What do you make of that? Because that, that's Tony Clark calls that the next wild card in the Bakken. And you talk about volatility. Natural gas could spike up to 67 bucks next week and we could see a natural gas renaissance out in the Bakken. So, what are you guys

Ed Schafer

doing there? You know, first of all, natural gas is not gonna spike up, you know, the, the, the supply that's out there versus the demand is such to where we, you know, we see $3 a uh uh you know, three to even a little less in some places. And then that's gonna stay around for a while. The, the prices are inching up. If you look at the forward hedging on sale prices and gas and things over the next few years, you're gonna see a little bump in prices but nothing dramatic.

And uh but, but importantly, um you know, continental resources to answer your question is an oil company. You know, the vast amount of our efforts and investments in capital expenditures go to extract oil. A lot of the gas play that we have at Continental comes from oil discoveries and liquids that are in gasses, etcetera. But, you know, the innovation is amazing because, you know, there, there are now today are all kinds of companies that are working on, you know, how can you

manage the natural gas on site? How can you extract the liquids on site and you know, and just ship the gas and, and things that, that are really happening. Continental as a matter of fact, um where North Dakota on average extracts or flares, about 30% of the gas, Continental flares 10 and they've done it by innovative ways of figuring out how to, um, you know, how to move that gas, how to store it, how to get it to the processors. But importantly, Continental has done it by making

commitments to the pipeline companies so that they know they've got a revenue stream to invest in pipes and collectors and tanks to get that gas moved. So, you know, importantly, um North Dakota is finding ways to reduce that flaring. Um It's important for us to do the legislatures, put some incentive to do so in. But the company's economic incentives are really what is uh pushing our efforts to uh to collect that gas and to recognize the economic value. So

Jason Spiess

what's Continental's future? What, what are you guys looking

Ed Schafer

at here? Well, Continental, uh you know, our plans are to triple the size of the production uh in five years. Uh, and, and that's like the best sound

Jason Spiess

I've ever heard in my

Ed Schafer

life. ... You know, it, it's pretty amazing that the company is growing rapidly. Um, you know, really the amount of mineral rights that are owned by Continental across this country in proven oil and gas plays are tremendous. We're fighting every day to figure out how can we raise the capital to realize that the usage of those mineral rights? And, you know, you get, you get capital constraint because there's so much opportunity you just don't have the money to be able to, uh, explore

and extract all of the natural researchers, researchers that are out there. But, um, you know, we, we, we've mapped out a way to triple the size of the company and, um, and, yeah, yeah, plan on doing that.

Jason Spiess

So you, you're serious about tripling the size of the company? Oh, ok. Well, good luck with that. Well, uh, uh Tyler, anything with the Tyler. And you guys do.

Ed Schafer

I, I, you know, I love the Tyler play. You know, first of all, it was a, it was the Tyler play was a pre play and it's important for us to remember. But if you look at the shape of the Tyler, the geological formation of the Tyler, its shape runs to the south and, and southwest of the Bakken. And what we're seeing now is now, is mineral as, as the Bakken has become proven reserves as we've shaped that play up there.

Um, what's next? You know, where are you going next? Well, what's next? It looks like in North Dakota is, people are, are mineral rights are being purchased. The activity is starting to go to the south and southwest. The Tyler formation is more of a straight vertical. Well, drill, the oil is close to the surface. It's kind of in pools instead of in seams.

So it is a little less expensive to extract. But importantly, it is, it moves the activity out of the north and, and uh northwest of the state to the south and the southwest and, you know, the south and the southwest, we've had, we've had um uh those plays going on since the fifties and the, the infrastructure is more developed, the collections, more developed the, you know, the, the, the um, activity I think is, is, is, is kind of, uh we're used to that activity in the marketplace.

So it's gonna have, it's gonna be able to spread out the activity across a wider geographical range in North Dakota. But it's also moving into an area that I think is more manageable and easier for the state to deal with. And so I'm, I'm excited about the Tyler play. I think it's, um, it's really gonna be an important economic aspect for the State of North Dakota and, and, and it looks like there's a lot of activity moving that way.

Like I said, you know, you're dealing with that 3 to 5 years out. Not tomorrow. But if you look at mineral purchases, you look at, you know, installations, tanking pipes, storage yards, the stuff that's been rented and built and stuff. It's, you know, it's moving that way and I think that's an exciting play for North Dakota. You can see

Jason Spiess

the trends, you can see the trends. Governor Schafer. Thank you very much.

Ed Schafer

Thank you.

Please consider supporting those who are Living The Crude Life! The oil and gas worker is experiencing the same public relations issues the farmer’s faced decades ago when the grocery story replaced them. Only it’s the light switch that has replaced those Living The Crude Life.

Your company and/or personal support will allow positive, informational and educational stories, interviews and podcasts to continue. Real talk. No scripts. Just energy experts and real crude talk.

Paid Subscriptions are only $5 and keep the articles, podcasts, news, essays and insights coming.

Network online, in social media groups and in podcast land! Support the industry’s voice for only $5!

Did you know supporting The Crude Life is more sustainable for the planet than a $5 Starbucks Coffee? You have the power to make a difference! Support The Crude Life today!

For guest, band or show topic requests, email studio@thecrudelife.com

About The Crude Life

Award winning interviewer and broadcast journalist Jason Spiess and Content Correspondents engage with the industry’s best thinkers, writers, politicians, business leaders, scientists, entertainers, community leaders, cafe owners and other newsmakers in one-on-one interviews and round table discussions.

The Crude Life has been broadcasting on radio stations since 2012 and posts all updates and interviews on The Crude Life Social Media Network.

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

#thecrudelife promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

Spread the word. Support the industry. Share the energy.

Click on picture for BIG SAVINGS! Check out these Amazing American Environmental Entrepreneurs! Don’t forget that the promo code OTIS unlocks big big savings!

if link is broken, use promo code OTIS at www.mystore.com and www.mypillow.com

Share this post