The Dallas Fed conducts a quarterly survey of about 200 oil and gas firms located or headquartered in the Eleventh District—Texas, southern New Mexico and northern Louisiana—which operate regionally, nationally or internationally.

The information collected is a valuable component of economic analysis and serves as input for Federal Open Market Committee monetary policy deliberations. Survey respondents are asked whether various measures of their firms' business activities have increased, decreased or remained unchanged relative to the prior quarter and the year-ago quarter. Responses are aggregated into diffusion indexes; positive values indicate expansion while negative values indicate contraction.

Activity in the oil and gas sector increased slightly in fourth quarter 2024, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index, the survey’s broadest measure of the conditions energy firms face in the Eleventh District, increased from -5.9 in the third quarter to 6.0 in the fourth quarter.

The company outlook index turned positive in the fourth quarter, increasing 19 points from -12.1 to 7.1, suggesting mild optimism among firms. The outlook uncertainty index declined 26 points to 22.4.

Oil and gas production was mixed in the fourth quarter, according to executives at exploration and production (E&P) firms. The oil production index remained positive but declined from 7.9 in the third quarter to 1.1 in the fourth quarter, suggesting oil production was relatively unchanged during the period. Meanwhile, the natural gas production index remained in negative territory but lifted from -13.3 to -3.5, indicating gas production edged lower.

Costs rose at a similar pace when compared with the prior quarter. Among oilfield services firms, the input cost index was relatively unchanged at 23.9. Among E&P firms, the finding and development costs index was relatively unchanged at 11.5. Meanwhile, the lease operating expenses index increased slightly, from 21.3 to 25.6.

Conditions among oilfield services firms weakened, albeit at a slower rate. The equipment utilization index for oilfield services firms remained in negative territory, improving from -20.9 in the third quarter to -4.4 in the fourth quarter, suggesting the pace of the decline slowed significantly. The operating margin index increased from -32.6 to -17.8, indicating margins declined at a slower rate. The prices received for services index declined from -2.3 to -13.0.

The aggregate employment index was relatively unchanged at 2.2 in the fourth quarter. While this is the 16th consecutive positive reading, the low-single-digit result suggests little net hiring. The aggregate employee hours index moved up to zero. Additionally, the aggregate wages and benefits index ticked up from 18.6 to 21.7.

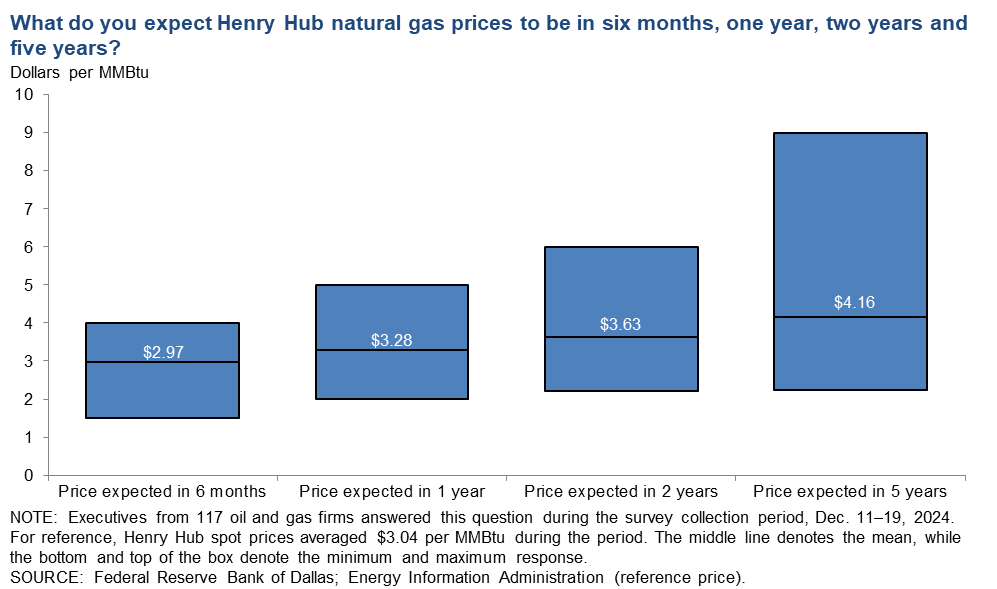

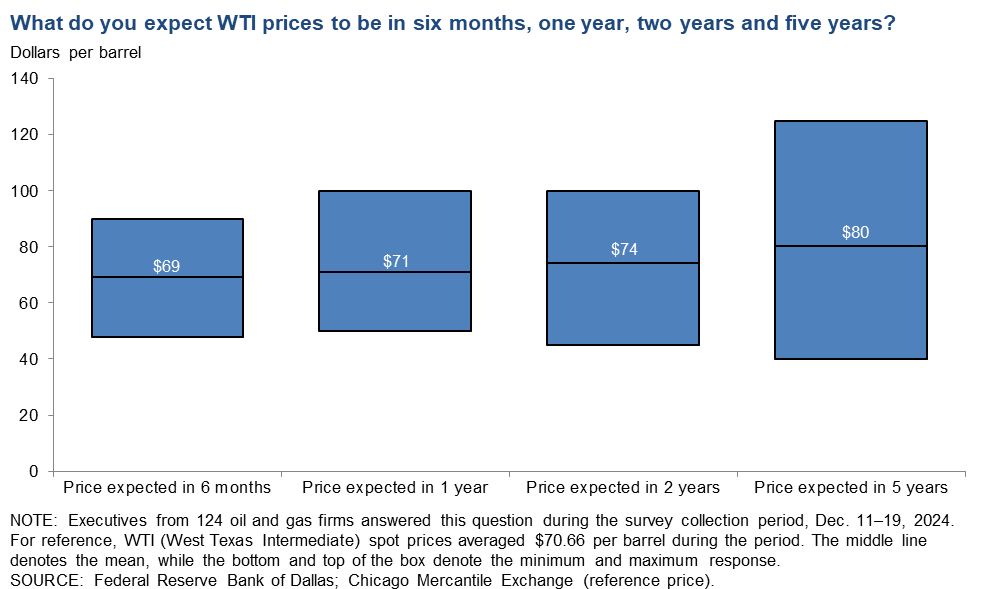

On average, respondents expect a West Texas Intermediate (WTI) oil price of $71 per barrel at year-end 2025; responses ranged from $53 to $100 per barrel. When asked about longer-term expectations, respondents on average expect a WTI oil price of $74 per barrel two years from now and $80 per barrel five years from now. Survey participants anticipate a Henry Hub natural gas price of $3.19 per million British thermal units (MMBtu) at year-end 2025. When asked about longer-term expectations, respondents on average anticipate a Henry Hub gas price of $3.63 per MMBtu two years from now and $4.16 per MMBtu five years from now. For reference, WTI spot prices averaged $70.66 per barrel during the survey collection period, and Henry Hub spot prices averaged $3.04 per MMBtu.

Next release: March 26, 2025

Data were collected Dec. 11–19, and 134 energy firms responded. Of the respondents, 87 were exploration and production firms and 47 were oilfield services firms.

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District. Firms are asked whether business activity, employment, capital expenditures and other indicators increased, decreased or remained unchanged compared with the prior quarter and with the same quarter a year ago. Survey responses are used to calculate an index for each indicator.

Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the previous quarter.

If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the previous quarter.

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

Email your sustainable story ideas, professional press releases or petro-powered podcast submissions to thecontentcreationstudios(AT)gmail(DOT)com.

#thecrudelife promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

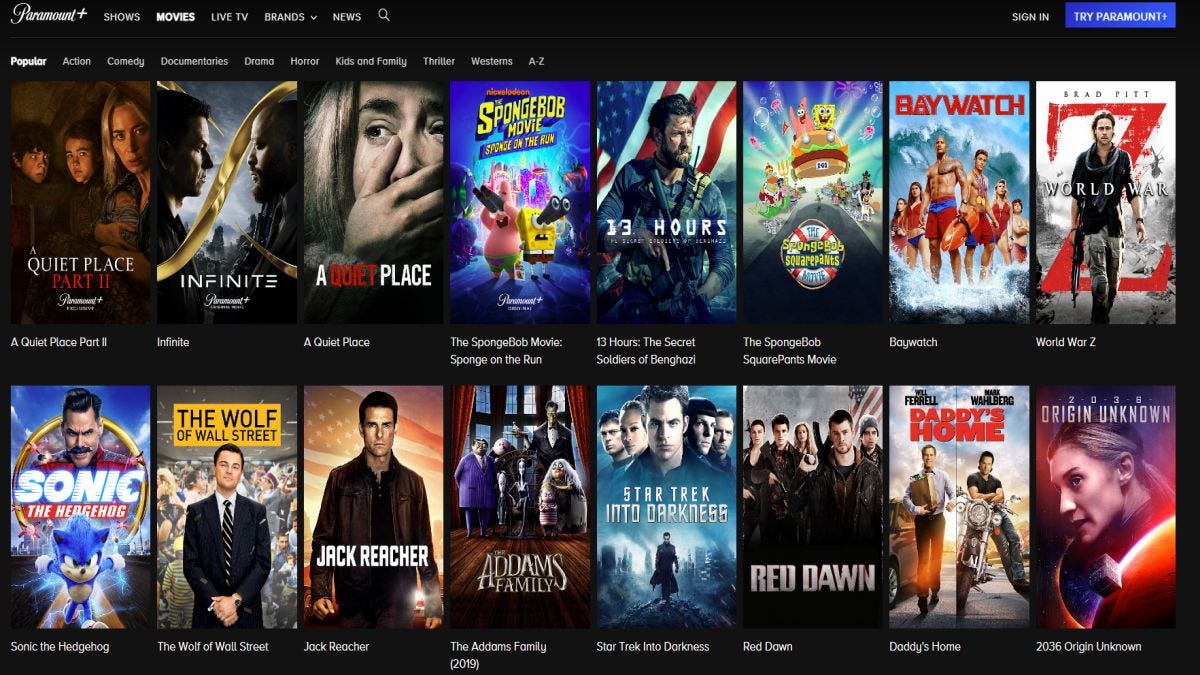

CLICK HERE FOR SPECIAL PARAMOUNT + DISCOUNT LINK

Paramount+ offers its subscribers a plethora of quality content.

From classic films to banger TV shows like 1883 and Star Trek: Discovery, there’s no shortage of entertainment to explore.

How about some cult favorites like Red Dawn, Grease and There Will Be Blood?

Start Streaming Today!

Share this post