Pumpjacks & Popcorn: Trading Places Offers Real Life Laughs & Loses

A mix of field grit and theater butter.

There’s a certain poetry to capitalism when it’s left to play out on a level field. As someone who’s spent decades in the oil and gas industry—where high stakes, high risk, and high reward intersect daily—few films capture the underlying mechanics of market manipulation, insider leverage, and the absurdity of social constructs better than Trading Places.

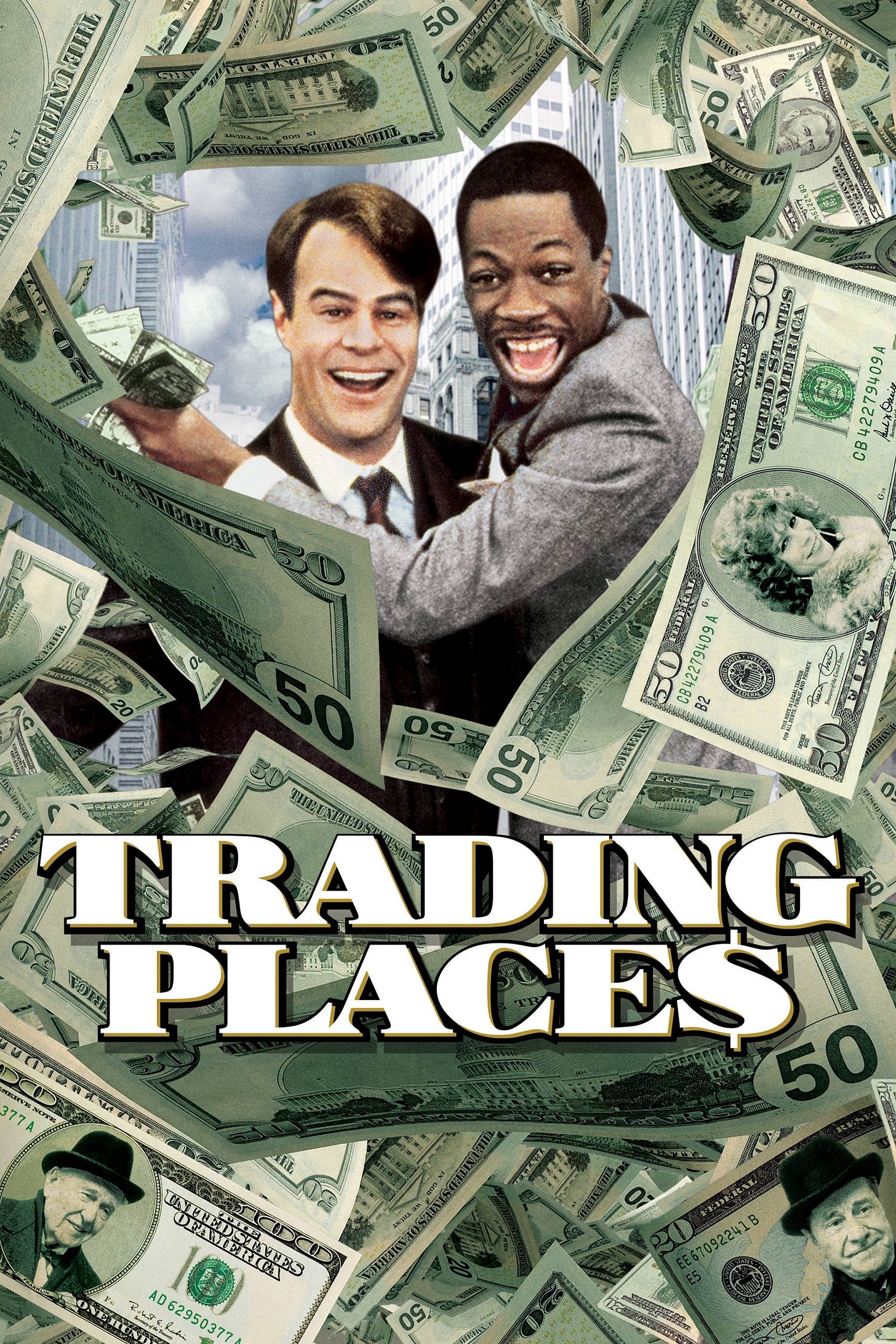

Directed by John Landis and starring Eddie Murphy and Dan Aykroyd, this 1983 classic doesn’t just entertain—it educates, subtly and sharply, about the rules of markets and the people who break them.

Plot as Commodity Futures Playbook

At its core, Trading Places is a reverse engineering of the American dream, with the commodities market as its battleground. Louis Winthorpe III (Aykroyd), a blue-blood commodities broker at the fictional Duke & Duke firm, is unceremoniously framed and replaced by Billy Ray Valentine (Murphy), a homeless hustler. The switch is the result of a nature-vs-nurture bet by the Duke brothers—two self-righteous oil-age capitalists who run their brokerage like a refinery: extracting value at any ethical cost.

The setting isn't a drilling rig, but the trading pit. The product isn't light sweet crude, but frozen concentrated orange juice (FCOJ)—a commodity with seasonal volatility that any oil and gas analyst could appreciate. It’s in this chaotic, caffeinated atmosphere of speculation that the film delivers its punchline: those with access to insider information (or strategic intelligence, as we say in energy trading) can tilt the market, manipulate prices, and devastate entire livelihoods.

Sound familiar?

In the upstream sector, we call this the difference between seismic intelligence and wildcat guesswork. And while our industry might not trade in citrus futures, the market principles apply universally.

Wall Street with a Laugh Track

Unlike Wall Street or The Big Short, Trading Places wears its satire like a well-tailored Brooks Brothers suit. But behind the comedic antics lies a sobering truth: markets can be gamed, and the little guy often loses. Valentine and Winthorpe’s ultimate revenge—using falsified crop reports to corner the FCOJ market and bankrupt the Duke brothers—feels particularly satisfying for anyone who has watched price manipulation run rampant in oil futures, only for the regulators to arrive days (or decades) too late.

If you’ve ever sat in a boardroom as a pipeline expansion gets fast-tracked due to insider land acquisition, or watched crude prices spike on rumor rather than reality, this film hits home.

Murphy & Aykroyd – The Dual Fuel Engine

Eddie Murphy’s portrayal of Billy Ray Valentine is peak ‘80s charisma, but also razor-sharp economic commentary. He learns the rules of trading faster than most junior analysts pick up hydrocarbon reservoir models, and his streetwise skepticism becomes a business advantage.

Dan Aykroyd’s Winthorpe is a fossil of old wealth, initially oblivious to the forces that prop up his privilege—until he finds himself financially fracked and socially orphaned.

Together, they run the perfect arbitrage: one part instincts, one part insider play, and a whole lot of revenge-fueled motivation.

Lessons for the Oil Patch

Information is the real resource – Whether it’s the USDA crop report or next quarter’s drilling productivity forecast, the one who holds data before it becomes public can shift billions. That’s true in commodities, and doubly true in hydrocarbons.

Market manipulation isn't a conspiracy—it’s a strategy – The Dukes are villains, yes, but their methods aren’t far from tactics used in hostile takeovers or speculative land leasing in the Permian Basin. Watch their playbook and you’ll understand half the E&P bankruptcies of the past decade.

People are just as volatile as oil prices – Winthorpe and Valentine prove that human capital is undervalued. Skills, when applied in the right market conditions, can outproduce even the most secure natural resource.

The system protects its own—until it doesn’t – The fall of the Dukes is a cautionary tale for legacy operators in the energy sector who believe their political leverage or institutional longevity is unshakable. We’ve seen it with Enron, Chesapeake, and countless mid-tier operators.

Final Verdict

As an oil and gas professional, Trading Places isn’t just a comedy—it’s a fable with flare gas. It reminds us that markets are human constructs, prone to error, arrogance, and the allure of easy manipulation. But it also shows us the flip side: redemption, reinvention, and the disruptive power of people who understand how to read the market better than the legacy institutions they challenge.

Rating: 4 out of 5 Barrels 🛢️🛢️🛢️🛢️

A classic that teaches the rules of capitalism, and how to beat them—whether you’re trading orange juice or West Texas Intermediate.

Jason Spiess is an multi-award-winning journalist, entrepreneur, producer and content consultant. Spiess, who began working in the media at age 10, has over 35 years of media experience in broadcasting, journalism, reporting and principal ownership in media companies. Spiess is currently the host of several newsmagazine programs that air across a 22 radio stations and podcasts worldwide through podcast platforms, as well as a social media audience of over 400K followers.

.CLICK HERE FOR SPECIAL PARAMOUNT + DISCOUNT LINK

Trading Places is available for streaming on Paramount +

Paramount+ offers its subscribers a plethora of quality content.

From instant classic films to banger TV shows like 1883 and Tommy Boy, there’s no shortage of entertainment to explore.

How about the new series Happy Face? It’s getting fabulous reviews.

Start Streaming Today!